Explore Our Full Range of Bookkeeping Services

-

![record keeping]()

Meticulous Record Keeping

We ensure accuracy and compliance through meticulous QuickBooks coding, applying industry best practices and detailed categorization to every transaction. This structured approach not only minimizes errors and supports regulatory requirements but also provides a clear, reliable foundation for your financial records, enabling informed decision-making and long-term business growth.

-

![Precise Reconciliations]()

Precise Reconciliations

Our reconciliation services guarantee that your bank statements align seamlessly with your internal financial records. By conducting thorough reviews and identifying discrepancies early, we help prevent costly errors and maintain accurate reporting. This process ensures financial clarity, supports compliance, and provides you with confidence in the integrity of your business’s financial data.

-

![Person analyzing financial charts and data on a tablet with a stylus at a cluttered desk.]()

Efficient A/R & A/P Management

We specialize in streamlining your accounts receivable and accounts payable processes through structured workflows and advanced tools. Our approach ensures invoices are processed accurately, payments are made on time, and collections are managed effectively. By reducing delays and minimizing errors, we help maintain healthy cash flow, strengthen vendor and client relationships, and provide your business with the financial stability needed for growth and long-term success.

-

![Close-up of a person's hand using a tablet, seated indoors with a plant in the background.]()

Comprehensive Reporting

Gain a clear and complete picture of your business’s financial health with our detailed profit and loss reports. These reports go beyond basic summaries by breaking down revenue streams, expenses, and net profitability, giving you actionable insights into performance trends. With accurate and timely data at your fingertips, you can make informed decisions, identify growth opportunities, and maintain confidence in your financial strategy.

-

![A person sitting at a table with tax forms, a calculator, a pen, a smartphone, and papers related to tax filing.]()

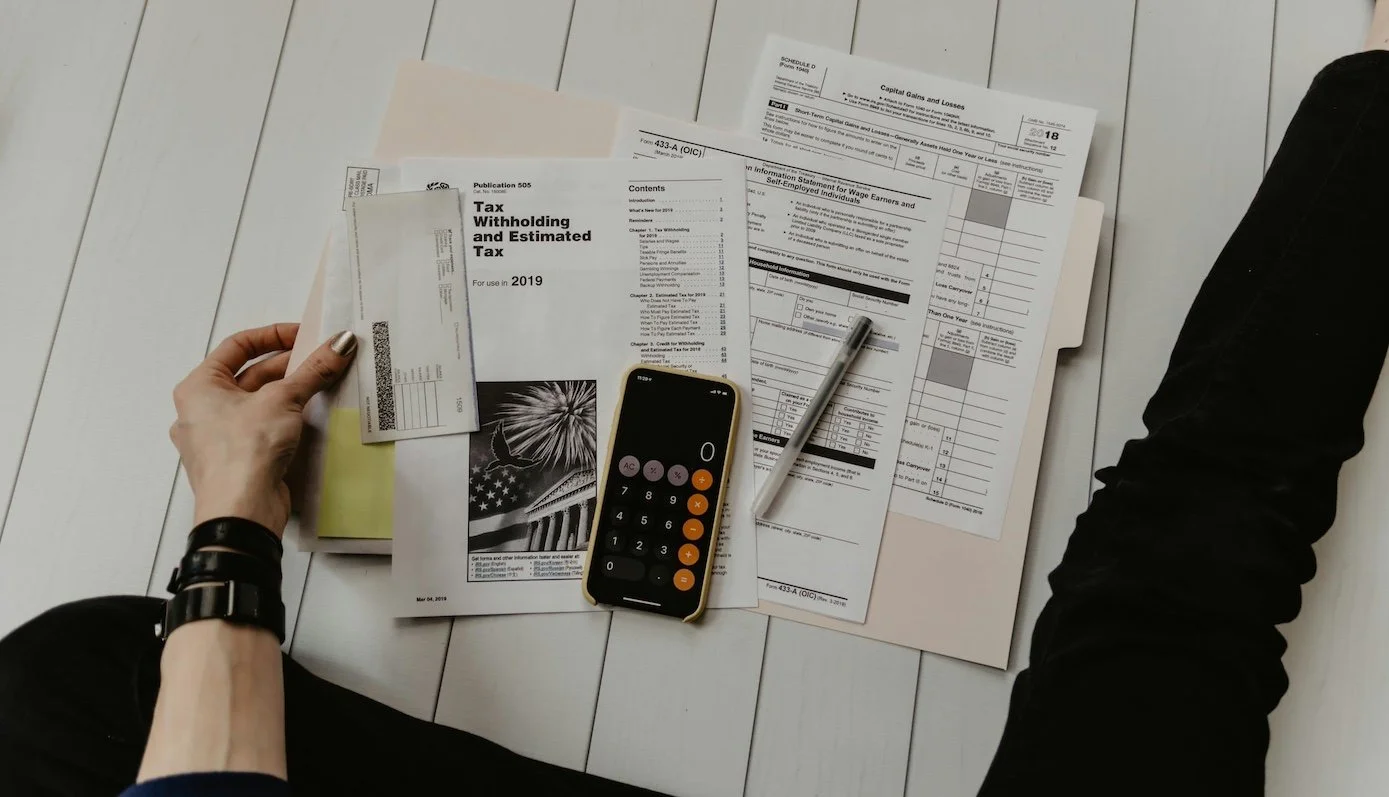

Tax Filings Made Easy

We take the stress out of tax season by managing all your essential filings with precision and care. From federal forms like 940s and 941s to state requirements such as TWC and EFTPS submissions, as well as 1099 reporting for contractors, we ensure every detail is handled accurately and on time. Our proactive approach helps you stay fully compliant with current regulations, avoid costly penalties, and maintain peace of mind knowing your business’s tax obligations are in expert hands.

-

![A white calendar page with a week view, showing dates from the 1st to the 30th, with red pushpins marking the 5th, 11th, 17th, 24th, and 30th.]()

Never Miss A Deadline

Our team takes the guesswork out of payroll tax compliance by ensuring every deadline is met accurately and on time. From calculating withholdings to submitting required filings, we manage the entire process so you can focus on running your business. By staying ahead of due dates and monitoring regulatory changes, we help keep your company in good standing with all relevant authorities, avoiding costly penalties and maintaining peace of mind.

-

![Person analyzing financial graphs and charts on paper, with a calculator, notebook, and laptop on desk.]()

Comprehensive Reporting

Our payroll reporting services go beyond basic summaries to deliver detailed, actionable insights. We provide in-depth payroll reports, including profit and loss statements, expense breakdowns, and trend analyses, giving you a clear and accurate picture of your payroll costs over time. These reports help you monitor labor expenses, identify patterns, and make informed decisions that support budgeting, compliance, and long-term financial planning. With precise data at your fingertips, you can maintain control and confidence in every aspect of your payroll management.

-

![A person's left hand typing on a laptop keyboard, wearing a brown leather wristwatch with a white dial and multiple smaller dials, on a dark wooden surface.]()

Save Time and Resources

Managing payroll can be time-consuming and complex, pulling your attention away from the core activities that drive your business forward. By outsourcing your payroll to Priority Bookkeeping, you eliminate the burden of handling calculations, tax filings, and compliance requirements. Our team ensures accuracy and timeliness, freeing you to focus on growth, strategy, and serving your customers—not managing paperwork. This streamlined approach reduces stress, saves valuable resources, and gives you peace of mind knowing your payroll is in expert hands.